Good news: The “vibecession” appears to be over. Things are about to feel a whole lot more affordable. In fact, US inflation has reached a three-year low, and the Fed is cutting interest rates later this week, according to a bunch of economists. But in the meantime, Americans are still feeling squeezed and cutting their spending accordingly. People are skipping trips, DIY projects, and even forgoing car insurance. We all need cheaper prices, like, yesterday — and retailers are taking note. McDonalds is keeping its $5 value meal until December (and psst: they’re selling double cheeseburgers for 50 cents this Wednesday for National Cheeseburger Day). Amazon launched Amazon Saver, a private label of grocery staples that are mostly under $5.

When it comes to checking my own everyday spending, I’ve latched on to a few methods that help me save with or without a McDiscount:

Embracing the Japanese practice of mottainai to maximize my grocery haul

Comparison shopping my essentials to find the cheapest prices (check the difference between these Target and Walmart hauls)

PS: While many everyday items may feel $$$, you might be happily surprised if you’re in the market for these big-ticket items.

— Anna Davies, writer, New York City

for the group chat

The money stories everyone’s talking about.

“I felt, at times, as if my husband resented me — which made me resent him.” When you’re a woman, chasing your ambitions often comes with a sense of being penalized.

Private elder care is alarmingly expensive. Not being able to afford your aging parents’ needs does NOT make you a monster.

The economic output of Latinos in the US just hit a record high. It would be the fifth largest GDP in the world if we were talking about a country.

The Fed is finally cutting interest rates this week. Experts say it's "great news for middle class families," but we’re still waiting to see how that will translate to our weekly expenses.

The best protection against bad #MoneyTok advice? A healthy dose of "financial paranoia."

PS: Dressing for the job you want? Buy a pager.

follow the money

How the news affects your finances.

Is Your Home Ready for an Extreme Weather Event?

Here’s a scary stat: Nearly half of U.S. homes face “severe threat” from climate change, according to a report from Realtor.com. And many homes may not be equipped to handle that risk. This hasn’t been good for insurance companies, which have paid out more than $100 billion to claimants in 2024. Now, many insurance companies are refusing to provide homeowner’s insurance in certain states, or have made the cost prohibitively expensive.

Climate shifts have also been costly for consumers. Residents of formerly mild regions are investing in AC, others are paying for expensive repairs after an unexpected storm, and one survey indicated that 49% of homeowners have underestimated the impact of extreme weather on their home. But there are ways to get ready for whatever might come your way. Here, three things you can do to prep your home and finances for wild weather.Your move:

Consider flood insurance. Typically, houses in flood zones need to have flood insurance, per the mortgage company. But if you don’t live in one, and don’t have flood insurance, your insurance may still deny your claim if your home was damaged by a flood. Read the fine print in your policy, and consider additional coverage for peace of mind.

Don’t skimp on routine maintenance. Your home should be in optimal shape to stand up to extreme weather. For example, the impact of heavy rain can be minimized by making sure your gutters are clear. A home inspection can help you hone in on these things.

Be prepared. The Red Cross recommends having a “go kit” (food, including pet food, clothes, medications) a “stay-at-home kit” (water, food, batteries, a hand crank radio), and a plan for what you would do and where you would go if you need to evacuate. It’s also a good idea to put important documents in a fireproof safe — and not in your dishwasher, despite popular social media advice.

it’s grow time

Parental stress has become so crippling, the US Surgeon General declared it a public health issue. Unsurprisingly, money sits at the top of most parents’ stressor list — especially at the start of the school year.

We get it. Meeting your kid’s day-to-day needs while planning for their future is a tough balancing act. Enter: Fabric by Gerber Life's investment accounts for kids. Intentionally designed for busy parents, you can open an account in five minutes and start investing with as little as $20, then watch the money grow as your kids do. Use it for expenses along the way like school supplies or future costs like college tuition. Bonus: Fabric won’t charge you commission or hidden fees. Oh, and Skimm’rs get $25 if they sign up this week.†

†Terms and conditions apply

This is a paid endorsement for Fabric by Gerber Life’s UGMA (Uniform Gift For Minors Act) Offering and not a paid endorsement for advisory services. Investing in securities involves the risk of loss. Age of Majority varies by state. Please read the offering circular at meetfabric.com/UGMA.

ask an expert

We asked you to vote on a question you’d like answered. The winner was:

What are the most common mistakes people make when starting a business?

FEATURED EXPERT:

Kerrie Carden

Founder of Equip Advisory, a career consulting firm

Building a business? Buckle up. An entrepreneur’s journey has more highs and lows than an episode of Love Island, but there are ways to minimize the “what was I thinking?” pain that often comes post-launch and pre- overflow of orders. Here, Carden shares three common mistakes new business owners make:

Not doing your research. “You must create something people are willing to buy for more than it costs to make,” she says. “You also need to sell enough of it to make a profit and stay sustainable.” Do some market research to test your idea before you launch. Here’s a helpful guide. Market research is more than asking friends what they think — build a survey in Google Docs, send to acquaintances, invite unsolicited opinions, and take everything in as you build on your idea.

Spending on stuff you don’t need. Do you truly need a fully-designed website, or can you use Instagram to start? You also don’t need all that fancy swag before your first sale. Go bare bones on extras until you begin generating income, suggests Carden.

Going solo. “In a regular job, you have people nearby to bounce ideas off and learn from, but that’s often missing when you’re an entrepreneur,” she says. Build a network of “colleagues.” Go to industry events, start chats with people you admire, and have a few trusted folks you can bounce ideas off.

Quotes are edited and condensed for clarity.

action items

How to win at work, according to successful women.

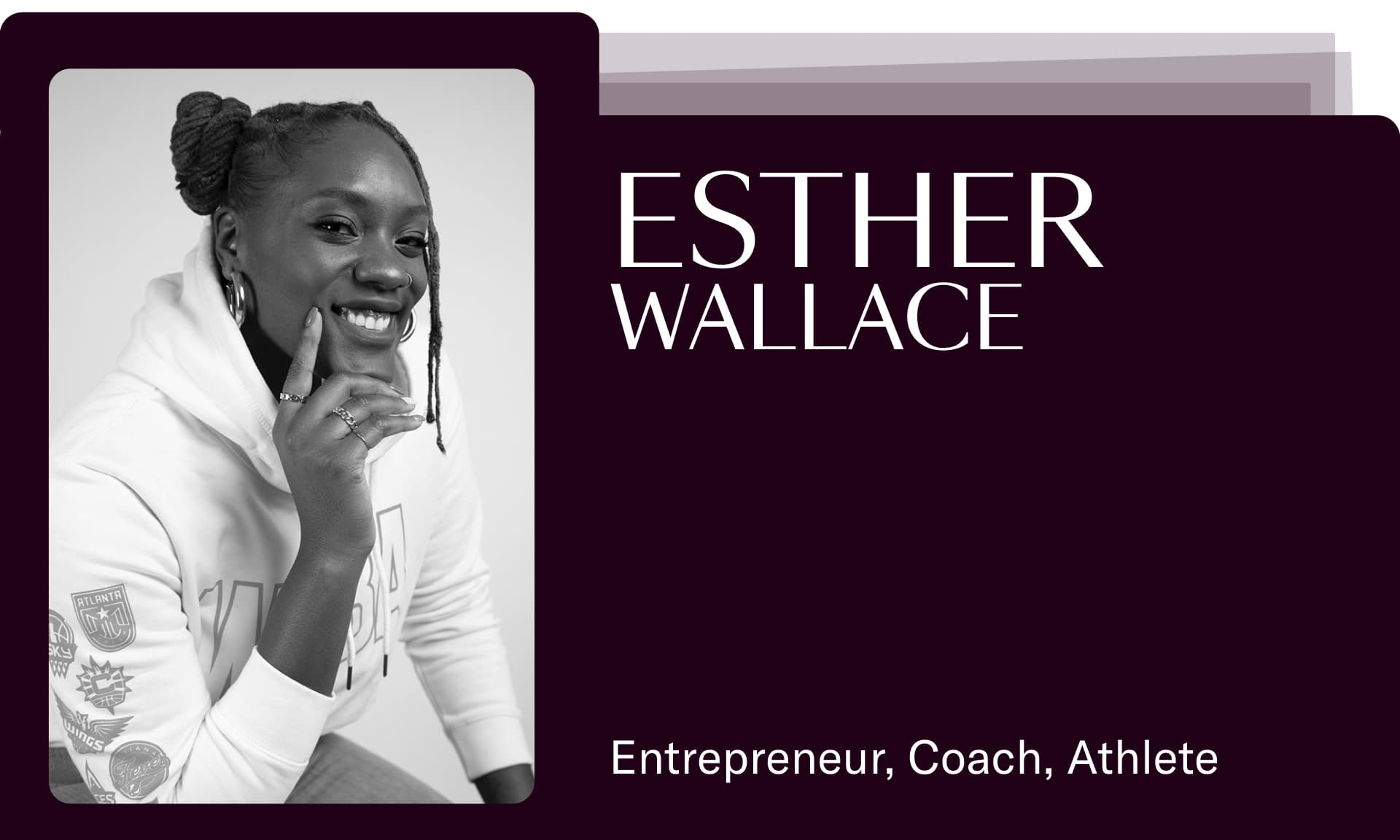

As a college basketball player, Esther Wallace was captivated by the passionate community in women’s sports and the WNBA. When she graduated, Wallace used her artistic talent to create a line of graphic t-shirts and sweats that stood out, made a statement, and honored amazing female athletes. Nearly ten years later, Playa Society’s tees and sweats are courtside staples and fan must-haves, with WNBA, NCAA, and USWNT collaborations featuring athletes like Caitlin Clark, Trinity Rodman, and Milaysia Fulwiley. Want to turn your business idea into a legendary success? Wallace has you covered.

Mistakes are essential.

“The right thing might not be the first or second thing you try, but the process will get you closer to the thing you want. When I look back, sometimes [I think] like: ‘No, that t-shirt was terrible. That was a bad idea.’ But I needed to do those things in order to get to where Playa Society is [now].”

The unknown is inevitable.

“You can study the playbook, you can study your competition and know their plays, but you don't know what's going to actually happen in the game. And so you have to be able to make adjustments quickly — you have to be able to read and react.”

That initial spark is your compass.

“Sometimes, our goals scare us, and we might change them to make them feel attainable, but don’t doubt that original vision. You might not end up exactly where you think you’ll be in 10, 20, or 30 years from now, but it will steer you in the right direction.”

Quotes are edited and condensed for clarity.

byline

Design: theSkimm | Photos: Halfpoint via iStock, Brand Partners, Jana Murr via iStock, Kerri Carden, Esther Wallace

Live Smarter

Sign up for the Daily Skimm email newsletter. Delivered to your inbox every morning and prepares you for your day in minutes.